Philosophers On Drug Prices

The price of Daraprim (pyrimethamine), a drug that treats the parasitic infection toxoplasmosis and is used in some cases to treat cancer and AIDS, was raised from $13.50 to $750.00 per pill when sole rights to its sale in the United States were acquired last month by drug company Turing Pharmaceuticals. The news brought outrage from all corners, prompting the owner of Turing Pharmaceuticals, Martin Shkreli, to announce that the price would be lowered—though he hasn’t said what its new price will be.

The price hike is not unique to Daraprim, a drug which has been around for decades. How does it happen?

Part of the problem is that there are individuals like Shkreli scouring the market for drugs like Daraprim that don’t have effective generic rivals (perhaps that market is too small for a generic drug maker to view it is profitable; perhaps, as in Daraprim’s case, there are unique issues surrounding the requirements for regulatory testing) or other factors that give the drug a lot of effective pricing power. The profit-minded individual or company snaps up the patents, suddenly hikes the drug’s price and puts consumers – from insurance companies to individuals – in a position of either paying what is demanded or going without.

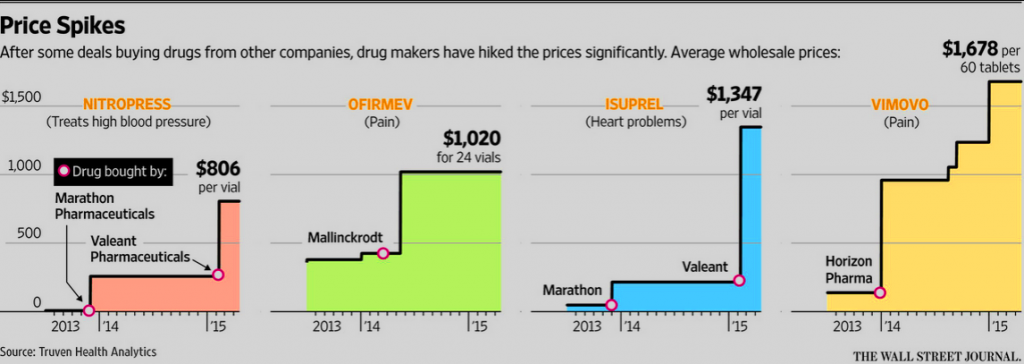

That explanation is from The Guardian, which provides some examples of other drugs the price of which have been raised in similar fashion. Here are some others:

The Daraprim price hike and others like it are now a subject of intense and widespread public discussion. Since these price hikes raise a number of issues in ethics, political philosophy, and philosophy of economics, I asked some philosophers to write up some of their thoughts about them in short, blog-friendly form. Contributing are:

- Nicole Hassoun (Binghamton University)

- Samia Hurst (University of Geneva)

- Chris MacDonald (Ryerson University)

- Jeremy Snyder (Simon Fraser University)

- Marcel Verweij (Wageningen University)

- Danielle Wenner (Carnegie Mellon University)

- Matt Zwolinski (University of San Diego)

I am grateful to them for participating on such short notice.

The idea of the “Philosophers On” series is to prompt further discussion among philosophers about issues and events of current public interest, and also to explore the ways in which philosophers can add, with their characteristically insightful and careful modes of thinking, to the public conversation. Others are, of course, welcome to join in. Additionally, if you come across particularly valuable relevant philosophical commentary elsewhere, please provide a link in the comments.

New Incentive Structures for Pharmaceutical Companies Can Save Lives

Pharmaceutical companies’ should not purchase drugs for neglected diseases only to raise prices dramatically. No one has the right to make it difficult or impossible for people to secure life-saving medicines. The Human Rights Guidelines for Pharmaceutical Companies in Relation to Access to Medicines specify, for instance, that “companies must do all they reasonably can to ensure that medicines are available in sufficient quantities in the countries where they are needed.” They also suggest that companies are obligated to contribute to the development of drugs for neglected diseases. Companies must make sure the drugs they produce are accessible to all patient groups—not just rich patients or those in developed countries.

Turing Pharmaceutical’s decision to purchase and then dramatically increase the price of pyrimethamine (Daraprim) might have had major global health consequences. Pyrimethamine is not only used to treat toxoplasmosis but is also a key component of one of the world’s most important anti-malaria medicines, artesunate-sulphadoxine pyrimethamine (AS+SP). Sanofi holds the original patent on AS+SP and Gullian Pharmaceuticals distributes the drug through the Global Fund. Still, pyrimethamine can be combined with artesunate-sulphadoxine from other sources. Turing’s press department had “no specific information about Turing’s plans for distribution of Daraprim outside the US for anti-malarial treatment” (Allan Ripp, email communication, 9/22/15).

In any case, the general trend of companies purchasing older (even generic) drugs solely to raise prices and profits is disturbing, even tragic. Recently, another company purchased and attempted to raise the price of cycloserine, an essential medicine for the treatment of drug-resistant tuberculosis. Millions of people’s lives hang in the

balance.

There is no good justification for letting companies charge whatever they want for even their generic technologies. Turing’s CEO Martin Shkreli argues that this is necessary for Turing to help people access essential medicines who could not otherwise do so because they could not conduct research and development into new medicines. But the research and development Turing is doing will primarily benefit the world’s rich especially if the resulting medicines come with high price tags (their website suggests they are investing in toxoplasmosis and a few other health issues common in developing countries and some rare diseases; they do not focus primarily on malaria or neglected tropical disease research). Shkreli might argue that eventually (when prices fall) even the poorest will be able to access essential medicines. But if the trend is towards raising costs on old medicines, the argument pales in the light of reason.

We should instead create new incentives for pharmaceutical companies to invest in what matters and come up with alternative ways of rewarding (or conducting) essential research and development. We also need to make sure that the resulting technology is available around the world. There are many creative proposals for doing so on the table (we might consider Jamie Love and Aidan Hollis et. al.’s suggestion of a second patent system for essential medicines or more state funded R&D). In the meantime, prudent regulation is essential. As Boldrin & Levine put it in Against Intellectual Monopoly (Chapter 9, p. 16):

There can be no excuse for allowing either the idea or reality of private property to interfere with the business of saving one’s fellow man. If compensation for the taking of medical and pharmaceutical patents need be paid, so be it. But we can only hope that along with the great mass murderers of the 20th Century—the Stalins and the Hitlers—there is a special place in hell reserved for those who stood by and refused to act while those around them died.

If, as recent critiques of proposals for positive change suggest, large corporations have become too powerful to control, our political system is fundamentally broken.

What Justifies Pharmaceutical Profit-Making?

A very interesting case, this Daraprim story. Bear in mind that it is no isolated example. On many fronts, drug prices are hiking up. Some, like the anti-hepatitis C Sofosbuvir, are truly new and highly effective. Some are, let’s say, less effective. Some, like Daraprim, are not new. In examples across the board, though, higher costs are attracting attention. Importantly, these are not cases where high investments in drug development justify some modest profit requiring high prices. The cases getting heat are mostly drugs being sold at what looks like the highest price that can credibly be supported by the market, in what increasingly resembles a very straightforward racket: “you need this, we have it, hand us your money”. From this angle, companies attempting to look good by promising to give away some set amount of these highly expensive drugs to the destitute quickly start to look like mafia bosses who give to charity.

To this, the easiest reaction is to blame those who have set these prices. It is more interesting, however, to ask how such a thing has become possible. Part of the answer, it seems, is while we do agree that making a profit from finding, developing, and selling pharmaceuticals is legitimate, we were never truly clear about what made it so. Perhaps we approve this profit because we believe that the effort and creativity involved in bringing a new drug to the market deserves to be paid for. Perhaps we consider that the manufacture of a drug also merits payment. Perhaps we are not considering merit at all, but looking to the consequences: we want to incentivize the development of new therapeutic advances. Perhaps we want to guarantee that access to needed medical therapies is kept up by the profit motive.

What is fascinating about the Daraprim case, and a few others, is how obviously these traditional justifications don’t apply. It is very clear that any effort involved in developing this drug has long been paid for and that any further profit cannot be deserved in this way. Manufacturing it still costs money, of course, but nowhere near enough to justify its current cost. Finally, rather than guaranteeing access, this sort of price hike seems almost designed to limit it. Yet, this move is, to all appearances, perfectly legal. This is a situation, then, where our collective confusion has real financial—not to mention life and death—costs.

We Lack a Clear Theory of Just Pricing

The fundamental philosophical problem with regard to drug prices is that we simply don’t have anything like a theory of just pricing. People react instinctively to high prices, especially in relation to life-saving drugs, but those intuitive reactions can’t easily be cashed out in theoretical terms. If you ask, “what’s a fair price for a life-saving drug?” you may hear some likely candidate principles but I think all of them fail. So the default is to let manufacturers and distributors charge what the market will bear. Many find this morally unsatisfactory, both on consequentialist and deontic grounds. So the rough answer will be that prices should be lower. Just how low might be unclear, but certainly not as high as the market will bear. But what’s the ethical justification for charging something less than what the market will bear?

One possible option is for drug companies to react to need. If you price according to what the market will bear, some needs will go unmet. Instead, you should price your product so that you do the most good, or perhaps so that the most urgent needs are met. Here the problem is that our conventional understanding is that the duty of beneficence is a fairly weak one, and one that can be satisfied in any number of ways. Most major pharmaceutical companies have charitable foundations that supply drugs on a compassionate basis, either free or at a reduced price, to those in need. This in itself goes further toward satisfying any plausible duty of beneficence than most corporations or individuals can claim.

A second idea might be to charge less that what the market will bear on grounds of distributive justice. Many good things, including importantly access to healthcare, are very unequally distributed in the world. And most people think that’s a problem. However, even if we are committed to greater equality of access to healthcare, it’s not clear that cheaper pharmaceuticals are the most pressing need, from a social point of view. And even to the extent that cheaper pharmaceuticals would be desirable, it’s not at all clear that ad hoc price adjustments by individual pharmaceutical companies would be the best method of achieving that.

What about lowering prices on grounds of non-exploitation? In the most serious cases, charging what the market will bear can mean extracting exorbitant amounts of money from people who literally have no choice but to pay. But the wrongness of exploitation is hard to pin down. Roughly speaking, exploitation involves benefiting disproportionately from someone’s dire need. Those who engage in exploitation do something that “feels” a bit like more obviously wrong behaviors, such as extortion, but the parallels break down once you get to the details. It’s worth remembering that, in standard cases at least, the person paying the exploitative price really is benefiting quite substantially, and would certainly be substantially worse-off if the exploiter had never showed up in the first place. That is by no means a full endorsement of exploitative pricing. But given the complexity of the pharmaceutical market, and the role that the potential for high profits has in incentivizing investment and innovation, it does suggest that charging what the market will bear is at least not obviously wrong.

Finally, it’s worth pointing out that the market for life-saving pharmaceuticals is not a ‘normal’ one, structurally let alone ethically. The question of fair pricing is made more complex by the way the issue of ability to pay is influenced by regulators, insurance companies, charitable foundations, and so on. In general, I think that rather than seek an assessment of the fairness of a particular price, we ought to look at the ethical justification of the entire system of prices. A given price might be neither good nor bad, ethically speaking; it is the system as a whole that warrants assessment. In general, free markets — the kind where people charge what the market will bear — do relatively well in this regard, but it’s much harder to be sanguine about that when we look at a real-life market as complex as the market for life-saving drugs.

Why It’s Price Gouging, and why It’s Wrong

The decision by Turing Pharmaceutical’s Martin Shkreli to raise the price of the drug Daraprim from $13.50 to $750 per dose was met with charges of price gouging in numerous press articles and on social media, including in a tweet by Hillary Clinton. As I’ve said elsewhere, the popular use of the term ‘price gouging’ is problematic, often being used to criticize any price increase that consumers find unpleasant or unexpected and without any account of why these price increases are morally problematic. For example, increases in the price of gasoline due to supply disruptions are frequently criticized as ‘gouging’ by greedy oil companies or undisclosed others.

However, the charge that Shkreli has acted unethically, or more specifically that he is price gouging his customers, is justified. There are several reasons for this. First, Daraprim is, for many, a medicine essential to their survival. As a result, these patients (or their insurers) have little choice but to pay the price increase, in some cases sacrificing spending on other essential goods. Compare this to a case where a concert promoter suddenly raises the price on Taylor Swift tickets—crushing for her fans, surely, but not morally equivalent to the price increase for Daraprim.

Second, the market for Daraprim and its alternatives is not competitive. Turing Pharmaceutical purchased a patent on Daraprim that gives it the exclusive right to market this drug (in exchange for bringing it into compliance with current FDA regulations) even though it was discovered over 50 years ago. Moreover, Shkreli is using a closed distribution model that makes it very difficult and time consuming for other companies to develop and gain approval for generic versions of this compound. Thus, defenses of Shkreli along the lines that he is just ‘charging what the market will bear’ ring false in that the regulatory system in the US does not allow for genuine competition that would lower the price for Daraprim.

Finally, the price increase cannot be justified by increases in the cost of production of Daraprim, which remains unchanged. Shkreli has argued that the price increase is needed to pay for research and development of new drugs, the rationale given for patent protections of new pharmaceutical products. However, these protections are typically justified as recovering the costs of drug development, not as a fund raising device that may or may not actually be invested in new product development (an area where Shkreli does not have a track record).

While Shkreli has announced that he will rescind some of the price increase for Daraprim, it is not clear what the new price will be or whether it will address these concerns. Hopefully, the public outrage, this time rightfully placed, against Shkreli will create sustained pressure for reform of the pharmaceutical patenting system. Changes are needed not only to address the mechanisms used by Shkreli and others to introduce large price increases for older essential medicines but also to reform a global patenting system that often makes it impossible for those in low resource settings to access essential medicines.

Let Shkreli Pay the Price for his “Altruism”

Daraprim (pyrimethamine) is the only drug that is available for treating immune-deficient patients (HIV, cancer) who are infected with the toxoplasmosis parasite. Without this therapy, toxoplasmosis may lead to organ failure and blindness, and it would be a major cause of death in these vulnerable patient groups. A normal course takes three to four weeks, so the decision of the new owner of the drug, Martin Shkreli of Turing Pharmaceuticals, to raise the price tag per pill from $ 13,50 to $ 750 means a price increase for a regular course from $ 378 to $ 21,000. For some patients, the costs of treatment will be even much higher. Some years ago, the drug was available for just one dollar a pill, so arguably the drastic increase was not necessary to make the drug profitable. Yet, given that the pharmaceutical company has in fact a monopoly on the sixty year old patent free drug, Martin Shkreli can argue that Daraprim is worth much more than the previous price tag: “If there was a company that was selling an Aston Martin at the price of a bicycle, and we buy that company and we ask to charge Toyota prices, I don’t think that that should be a crime.”

The various news reports about this case, the responses of politicians and citizens, and other stories of how Shkreli dealt with ex-employees, paint a picture of a greedy, cold-hearted, morally bankrupt or even malevolent person who is mainly interested in making money and not in the wellbeing of others. Being pictured that way, Shkreli’s response that the profits will ultimately go to patients, as it will enable Turing Pharmaceuticals to promote patient compliance, educate doctors, and improve toxoplasmosis drugs, will probably not convince many.

But, merely for the sake of the argument, let us assume that Shkreli is honest and tries to make more money out of this old drug in order to do something good and contribute to people’s health. “There is much altruism in this”, he claims. Now would such altruism justify raising the price of the drug in this magnitude? A first problem is that, as investor, he probably still wants to see a return of his investment: acquiring the drug cost $50 million and at least part of the price hike will be used to pay back that investment. If this is altruism, it seems a relatively inefficient form of doing good.

A second question is concerned with fairness: is it right to make toxoplasmosis patients, or, in a broader sense, societal public health systems, pay for the altruist aims of Mr Shkreli? Just asking the question already reveals that this is not a matter of altruism at all. Shkreli is asking—or more precisely, requiring—patients and societies to pay for his pharmaceutical research and health education. Such research and education may be beneficent, but the term ‘altruism’ is completely misplaced if the ‘benefactors’ cannot escape paying for the benefits.

Yet even if this is no real altruism, might it still be fair that society pays for the expected beneficent innovations in pharmaceuticals that companies like Turing are planning? I don’t think it is. There are many ways in which public health and clinical care can be and should be improved, and societies cannot but set priorities in health policy and health research. In a democratic society, such priority setting should be accountable and fair, and this requires public deliberation and reasonable justification. Monopolist pharmaceutical companies that force a democratic society to pay for the innovations they see fit undermine justice in health care.

Fairness Demands More than the Absence of Coercion

If I own a thing, and I offer to sell it to you for X amount of money and you want that thing more than you want that amount of money, then we can make a trade. Assuming I haven’t manipulated, coerced, or threatened you, then we tend to characterize such an exchange as legitimate. Presumably we both walk away from the transaction better off than we were before, otherwise one of us wouldn’t have agreed to the terms. We might even call it a “just” transaction.

This is one story we could tell about the recent overnight price hikes of drugs like Daraprim, Nitropress, Isuprel, and cycloserine: the companies raising the prices on these drugs aren’t coercing anyone into using them, they aren’t manipulating sick people or lying to them about the drugs’ effectiveness. They’re simply offering to trade things with people who value those things more than they value the amount of money they’re being charged for them.

The problem with this story is that the procedural fairness of a transaction—that it is fair in the sense of being uncoerced, unmanipulated, and beneficial to both parties— does not necessarily imply the fairness of the transaction, all things considered. Often background features can function to undermine a transaction’s fairness by undermining the respective bargaining positions of the parties. This is most pronounced when one party to a transaction—though not coerced by the other party—is not in a position to reasonably refuse to transact. This can happen when one party has an effective monopoly. It can also happen when one party has a need so great that although there are no procedural constraints preventing her from refusing a transaction, such refusal will have such a bad outcome that it can’t be considered a real alternative. In such instances, it will often be the case that a “free” transaction between consenting parties will result in a trade that is grossly unfair in terms of its substance.

What is missing from the story above is a recognition of the fact, pointed out by political philosopher John Rawls, that given a large enough number of procedurally fair, mutually beneficial transactions, eventually the background conditions for substantively fair transactions (those fair in terms of their content) will be eroded. The distribution of wealth, left unchecked, may accumulate in a very few hands; or some subset of the population may be left without sufficient resources to ensure the ability to meet their basic needs. That this can happen as a result of a number of individually fair transactions suggests that truly “just” transactions must occur within the context of a certain kind of system of rules and regulations, for example, a system that protects individuals from finding themselves in such a weak bargaining position that they cannot refuse a job that pays $1.25 a day, or a system that prevents one entity from holding the only solution to a life-threatening illness and using that strength in bargaining position to demand prices that vastly outweigh the costs of production.

The liberal political tradition lauds the principle of respect for individual autonomy and the rights of persons to engage in free transactions. But absent social structures that function to ensure a sufficient baseline of well-being to all and to prevent the leveraging of monopolies over needed goods, individual autonomy and the right to freely transact are valuable only to those bargaining from the position of power.

OK, So Maybe Not All Price Gouging is Morally Permissible

I’ve written in defense of price gouging before. So readers familiar with my views might expect me to leap to Shkreli’s defense. But the defense of price gouging that I have offered is based on two arguments, one economic and one philosophical, neither of which apply to Shkreli’s case.

The philosophical defense of price gouging starts with the observation that even if standard cases of gouging are exploitative, they are also mutually beneficial. That is, they leave both parties better off than they would have been had the transaction not taken place at all. So, for instance, someone who sells bags of ice for $12 each to disaster victims desperate for some method of refrigeration might seem to treat his customers unfairly. But because those customers have no other way of getting the ice they need, they will often be better off taking the price gouger’s offer than rejecting it. And this raises a difficult philosophical puzzle: if the price gouger is doing something that makes desperate people better off, then how can what he’s doing be morally wrong? How can a gouger be morally worse than someone from the next town over who could bring ice to the disaster area but doesn’t, given than the gouger does something to improve the lives of disaster victims, while those other individuals do nothing at all?

I find this logic compelling. But however compelling it might be, it simply doesn’t apply to the Shkreli case. Shkreli is not bringing to patients a drug that would not have been available to them otherwise. He’s simply buying up drugs that were already available to patients and reselling them at highly inflated prices. That’s an important difference. You might loathe the price gouger who sells you ice for $12. But if you really need the ice and value it more highly than you value the $12 you give up for it, then you’re glad that gouger came into your life. Nobody, in contrast, is happy to see Martin Shkreli come into their life. By inflating the prices of drugs to which they already had access, he makes his customers worse off, not better.

How is Shkreli able to do this? This is where the economic argument comes in. In a lot of cases, the high prices that people decry as “price gouging” are economically defensible as part of a system that actually works to everyone’s advantage in the long run. In the pharmaceutical industry, for instance, it’s not unusual for companies to charge hundreds of dollars for pills that cost them only pennies to make. But often those high prices are necessary to recoup the cost spent researching and developing that drug, and the hundreds of other drugs that never made it to market. Charging a price that’s well above the “marginal cost of production” is the only way companies can make a normal level of profit over the long run, and therefore the only way to ensure that society gets the new drugs it needs. But Shkreli didn’t have any R&D costs for Duraprim. Those costs were already incurred, and presumably recouped, by the company that developed the drug 62 years ago. So that standard justification for high pricing doesn’t seem to apply here.

Shkreli is able to charge high prices because he is taking advantage of a legally created monopoly. Daraprim is a generic drug, no longer under patent. So, at least in this case, that’s not the problem. The problem is that in order to produce and sell even generic drugs in the United States, companies need to obtain approval from the FDA. And that approval can be very difficult, and expensive, to get.

In other countries, where competition is more robust, Duraprim is available for pennies a pill. The obvious solution, then, is free trade. As Alex Tabarrok has argued, a policy of reciprocity under which drugs approved for sale in Europe would be approved for sale in the United States as well, would mean lower prices and wider availability for patients everywhere.

Legal restrictions on trade and competition breed privilege, and privilege is what makes exploitation possible over the long run. In this case, as in so many others, the antidote is the leveling power of free competition.

Discussion welcome.

“In a lot of cases, the high prices that people decry as “price gouging” are economically defensible as part of a system that actually works to everyone’s advantage in the long run. In the pharmaceutical industry, for instance, it’s not unusual for companies to charge hundreds of dollars for pills that cost them only pennies to make. But often those high prices are necessary to recoup the cost spent researching and developing that drug, and the hundreds of other drugs that never made it to market.”

I suggest everyone interested in this issue read Marcia Angell’s The Truth About the Drug Companies and John Abramson’s Overdosed America: The Broken Promise of American Medicine. Both are MDs who know what they’re talking about.

“as investor, he probably still wants to see a return of his investment: acquiring the drug cost $50 million and at least part of the price hike will be used to pay back that investment”

I think we all need to rethink the famous Friedman claim that “the only business of business is business,” i.e., making profits for their shareholders. What ARE “profits,” anyway? Please consider the different ontologies at play: the abstractions of our humanly constructed economic symbol-game, versus the biological realities of human beings with real needs. Why did we humans invent money in the first place–wasn’t it to facilitate our living better lives? Another example of left-hemisphere thinking crowding out right-hemisphere grasp of lived realities, as per Iain McGilchrist’s analysis.

Matt Zwolinski wants to distinguish between the person who sells bags of ice to disaster victims for $12 each and the person who dramatically raises the price of a drug, as Martin Shkreli did. The morally important difference, according to Zwolinski, is that the ice vendor makes the disaster victims better off than they were while Shkreli does not. This is because the ice vendor makes ice available where it previously was not available while Shkreli merely raised the price of something to which patients (or their insurers) already had access at a much lower price. If this explains the difference between the two cases, then I wonder what we should say about the ice vendor who one day raises his price from $12 to $75 per bag. Is he doing something wrong now that he is bringing to his customers something that would have been, but for his decision to raise the price, available to them at a lower price? If he is, does this mean that absent a strong moral/economic justification it is wrongful for sellers to raise their prices? If he is not doing anything wrong when he goes to $75, then what’s the problem with what Shkreli did? Maybe the difference lies in the fact that Shkreli’s company is the exclusive owner of the drug, which is unique, while ice is in principle available from others. Then does this mean that those who hold patents act wrongly when they raise prices absent a moral/economic justification?

I think this case is interesting because it reveals that we can’t accept both that health care is just another commodity to be bought and sold on the market and that the Shkreli form of doing business is morally wrong.

Thanks, Moti. I think there’s a difference between (1) the case in which A was selling ice for $12/bag to C, then B buys all of A’s ice and starts selling it to C for $75/bag, and (2) the case in which A was selling ice for $12/bag, then A raises his price to $75/bag. In (1), the sum of A’s actions make C worse off. In (2), they make C better off. C is better off for A having come into his life; in (1), she isn’t.

For me, the strongest case that can be made in defense of “price gouging” is a defense of an institutional system that allows gouging to take place, rather than a defense of particular acts of “gouging” themselves. A system that allows steep price increases in response to changes in supply or demand is defensible because it works to the advantage of all – partly by leading buyers to conserve on scarce resources, and partly by encouraging new suppliers to bring goods and services to where they’re needed most. But those justifications don’t always apply to particular instances of price increases. And I don’t think they apply to Shkreli’s case at all.

Thanks for the clarification, Matt. I do see how B’s behavior differs from A’s and I agree that B’s behavior may be more objectionable on account of his not adding anything of value to C’s life while nevertheless charging him more. But I’m not sure this accounts for what’s objectionable about what Shkreli did, at least not fully. When A raises the price of a bag of ice from $12 to $75 he doesn’t add anything of value either, though as you say in sum C’s life is better than it was before A entered the picture. Maybe what’s bothering me is, in part, that the increase is a harm, since C is worse off having to buy $75 bags of ice than he was buying them for $12, and I want deliberate harms to be justified. When we know that the bag of ice sold for $12 yesterday and that the ice is no better today and that nothing else has changed besides the seller’s desire for more money, we may understandably object. Importantly, there are also other interested parties to keep in mind, namely, those who now can no longer afford ice (or medicine, or whatever). If Shkreli’s actions lead to lower adherence rates due to higher costs (as they do with some other drugs), then we are no longer talking only about people’s financial interests being set back, as they are when they pay more today than they did yesterday for the same thing. Now the problem is that some people can no longer afford what they could afford yesterday, a harm with which they must contend both with respect to a seller who dramatically raises prices and with a seller like Shkreli who has only recently entered the picture. In either case the sum of the seller’s actions make the buyer (or rather the former buyer) worse off and thus here the “new guy on the block” explanation can’t work.

Will Wilkinson has a nice analysis of this issue, similar to mine above.

https://niskanencenter.org/blog/martin-shkreli-show-us-how-regulation-drives-inequality/

Philosophy-student-turned-psychiatrist Scott Alexander has an informative take on some of the broader issues, here:

http://slatestarcodex.com/2015/09/24/the-problems-with-generic-medications-go-deeper-than-one-company/

This might be something Zwolinski addresses elsewhere (apologies if you do — I haven’t had time yet to read through the links you shared) but I’m wondering about this (particularly in light of Wenner’s contribution): “Legal restrictions on trade and competition breed privilege, and privilege is what makes exploitation possible over the long run. In this case, as in so many others, the antidote is the leveling power of free competition.” Is the claim supposed to be that even given the current distribution of wealth and resources, trade liberalization will reduce exploitation? Because that seems implausible. It seems like it would be even easier for monopolies to proliferate if there were fewer restrictions on them conjoined with existing extreme wealth inequality. Or is it a more limited claim? And if it is more limited, is it still true that free trade is supposed to be the obvious solution?

It seems pretty clear that in this single case, reciprocity of drug approval with states in Europe would almost certainly lower the price of the drug, given that Turing would no longer have a monopoly on its sale in the US. The two main factors influencing the existence of monopolies on generic drugs are the ease of state approval and the size of the market. The larger the market, the more likely a company is to start producing the drug. The easier it is to get approval, the lower the barrier of entry to the market and the more likely a competitor will join in the market. In the US with Daraprim, you have pretty much the worst case scenario: a very small market and a very difficult approval process. Insofar as trade liberalization reduces the barrier to market entry, competition will increase (although, again, maybe for not extremely tiny markets). It’s not quite clear what you mean when you say that trade liberalization would make it easier for monopolies to proliferate. At the very least, it’s hard to see how reciprocity of drug approval would make this situation worse.

Sorry if I was unclear — my question was about the general principles, not this particular case.

Kathryn, I’m probably much to late to join this discussion, but I feel compelled to add my 2 cents worth. Your Zwolinski quote is is exactly right. A monopoly and outrageous prices can ONLY exist where here are barriers to entry into a market as there is in this case. Most commentators have mentioned the problem, but haven’t pointed to it directly. Here is a generic drug that’s 60 years old. It isn’t patent protected, so anyone could make it, but only one company has a legal right to produce it due to the need for FDA approval. This is a government created monopoly, pure and simple. No one would dream of buying the rights to make this drug and sell it for $750/pill if they knew dozens of other companies would immediately start making this lucrative product and selling at a lower price.

There are multiple issues here which confuse the matter and I’m seeing a lot of promising points being made but also illogical conclusions/ summaries.

Let’s consider If a billionaire was diagnosed with a deadly and rare unknown disease. He might decide to pay a team of scientists to find a cure which would be very costly if funded all on his own. As non billionaire individuals we are unable to do the same for ourselves but together we can achieve the same results. In society we can get together and split the costs for common diseases. This is great for highly common diseases as we can spread the cost greatly but it will not work as well for those of us with very rare diseases. Given that ahead of time each of us don’t know what diseases we might get, maybe we can agree to all club in money to help fund research into many different diseases, so we’re all covered. This is why medical insurance and drug research companies make sense and together solve a big problem.

Let’s try separate the various issues in making this system work:

– Medical R&D is expensive/ risky/ uncertain and society needs to incentivise this activity for all of our benefits, otherwise it

wouldn’t happen. Patents are the best mechanism which we’ve agreed upon to do this

– Ahead of time each of us don’t know which disease we may be unlucky enough to end up with, so we should pool our

risks and insure ourselves.

– Private charity may well and should help the poor/ uninsured to pay for life saving drugs

– companies can spend money on R&D and then sell the resultant drugs themselves or sell the licence to another

manufacturer. Selling the licence for a proven drug at a handsome sum compensates you for your successful (and

unsuccessful) R&D efforts. The payer of that some while not having paid for R&D directly is paying for it indirectly and

needs a return on that investment.

– mixing or cherry picking from the above issues confuses matters. If a company decides to sell HIV drugs cheaply for philanthropic reasons for $12 a pill then that’s dandy but it does not mean that they have to continue to do that. If their coffers run dry and to help fund the next innovation they may well charge what the market can bear to help fund that. Similarly a non philanthropic company can come along and buy the licence and charge what they like.

– ideally this should attract competition so that prices do not go completely out of whack

– but due to government regulation/ intervention there are barriers to entry which protect incumbents e.g. FDA approval

and thus we do unfortunately see extreme prices that are not optimal

When you buy a drug licence it’s not for free, you need to recoup a return on that investment even though you didn’t spend money on R&D yourself. The consideration you pay to the inventor of the drug is the incentive to that company to continue to spend money on R&D and invent the next life saving drug for society whether they manufacture it themselves or sell the licence. Indirectly you are helping to pay for R&D on future drugs.

Unacceptably high prices? Insure yourself. those high prices are needed to incentivise innovation. Private charity should take care of our sorry countrymen who don’t insure themselves. This is the best imperfect system. Regulations protect incumbents and increases prices. Once again the answer is that we need less regulation not more. This encourages competition. Be skeptical of the emotive arguments of power hungry politicians – this is their favorite hunting ground.

It’s funny how the above capitalist arguments are often branded as evil and pro-business when in fact they are the opposite and are pro-consumer. Arguing for lower regulation of companies (which sounds like I’m favoring companies) means competition increases and companies in fact make lower profits – I’m arguing for us guys! I highly recommend watching Milton Friedman’s Free to Choose series which helps one better understand issues such as the above and the typical distortions that incumbent companies introduce and which politicians in cahoots use for their own benefit.